The tendency to defer online purchases is certainly not new, but in recent years it has established itself as one of the most requested practices by users, especially in a context in which digital trade represents an increasingly relevant share of daily expenses. If until today Paypal had made only the formula available Pay in 3 installments In the Bel Paese (a solution without interest, intended for medium -small amounts and designed to make lighter purchases than a few hundred euros), from today the service evolves with The arrival in Italy of a new option that allows you to divide payments into 6, 12 or even 24 monthsthus opening the road to the most consistent expenses and offering greater flexibility to those who prefer to manage the monthly budget with more graduality.

How the new Paypal installment payment works

The structure of the new installment plan does not completely differ from the model already known, activation always takes place at the time of the checkout and the experience for the user remains simplified, but some key elements change. In the case of payment in 3 installments, in fact, the minimum amount was set at 30 euros and the maximum one to 2,000 euros, with first immediate installment and interestless; The new option, on the other hand, covers a wider band, from 60 euros to 5,000 euros, and introduces a real financing with variable Taegcalculated on the basis of the credibility of the individual customer.

Another non -secondary detail concerns the timing, The first installment is not charged immediately, but only a month after the creation of the loanand the subsequent ones follow a fixed cadence until the chosen deadline (6, 12, or 24 months), with a share of capital and a share of interest specified in the contractual documents.

The new option is not indiscriminately available for everyone, in order to use it it is necessary to be of age, residing in Italy and owners of a personal PayPal account in order, since i Business profiles remain excluded; The approval is also not automatic but depends on several factors, including the reliability of the customer, the type of merchant and the nature of the transaction.

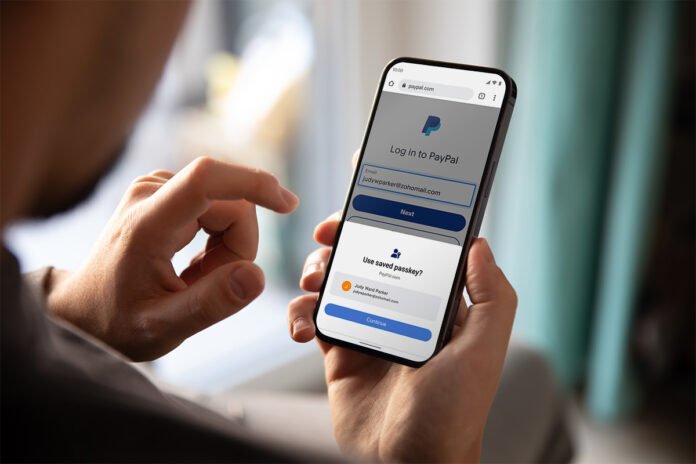

From a practical point of view, activation remains very quick, if you return to suitable customers At the time of payment, the option will appear Pays in 6, 12 or 24 installmentsaccompanied by a guided path that allows you to consult the terms and wait for the outcome of the evaluation (generally communicated in a few seconds). The installments are then automatically charged on the bank account or on the connected debit card at the PayPal account, with the possibility of reimbursement of the entire amount for those who want it in advance.

Once activated, the installment plan can be monitored by the PayPal app in the dedicated section Pay in installmentsor from desktop accessing the wallet; In both cases it is possible to check the residual balance, programmed payments and the transactions historian, as well as modify the debit method. However, there is an aspect to consider, in the event of orders composed of several items with separate shipments, the interests begin to mature from the first shipped product and the balance gradually updates with subsequent shipments.

With the launch of Pays in 6, 12 or 24 installmentsPaypal therefore expands the range of solutions available for Italian users, supporting the slimmer formula and without interest to 3 installments a method that allows you to face more expensive purchases, but with the application of costs related to financing; In this way, users will have greater freedom of choice, being able to calibrate the expense according to their needs, but at the same time they will be called to carefully evaluate the conditions, so as to understand which of the two roads (short term without interest or long term with applied rate) is more suitable for the type of purchase you intend to make.